For clients with available funds and a strong preference towards self-insuring linked benefit products are very attractive. The primary advantage of linked benefit products is that the buyer will get some benefit from their premiums even if they never need long-term care.

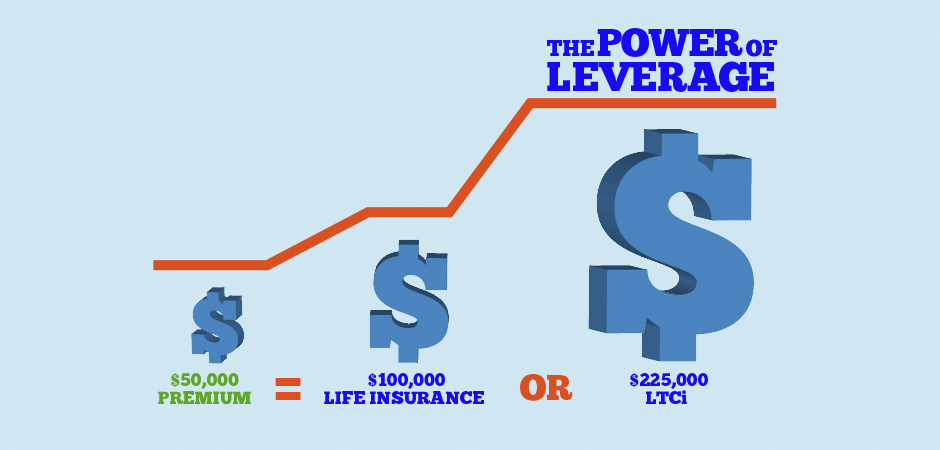

The concept behind linked benefit products is leverage. And, whether the strategy of choice is life linked to LTCi or annuities linked to LTCi, AIM offers both. This gives you maximum planning flexibility– especially with your affluent clients.

With health care reform looming, higher deductibles becoming the norm and more people looking for alternative treatments there is a tremendous demand for supplemental health benefits creating new sales opportunity for agents. Why AIM?

These products offer universal life insurance and long-term care rolled in to one product. This provides a pool of benefit dollars for long term care expenses, a death benefit for beneficiaries or both. This insurance solution is best suited for clients with available assets to reposition and the desire to see those assets returned to their estate is LTC is never needed.

Annuity Linked Benefit Plans

Fixed Annuities with LTC Benefits are investment vehicles that can provide safety of principal (no downside market risk), tax-deferred growth and an income stream for life. If you have assets currently invested in other vehicles, transferring some of these funds into a fixed annuity and LTC “Combination Product” may have some advantages.

The Benefit of 1035 Exchanges

Through the use of a 1035 Exchange, your clients can reposition existing funds into a Linked Benefit product, with no exposure to taxes and gain the ability to fund future long-term care expenditures.

When Traditional LTCi doesn’t fit, Linked Benefit Plans Can

AIM has a variety of linked benefit solutions available to you. Call your AIM marketer to help you find the appropriate solution for:

- Anyone who is concerned about the long-term care risk and has made a decision to self-insure.

- Individuals with life insurance needs and concern about paying future long-term care costs.

- Individuals who do not like the “use it or lose it” aspect of traditional long-term care insurance.

- Individuals with a minimum of $50,000 (or twice that for a couple) that this available to be repositioned into a “Combination Product”.

- Individuals who already have a life insurance policy or fixed annuity contract (outside its surrender period). These policies can be exchanged for a “Combination Product” with no tax consequences.

View Carriers

Get Started With AIM