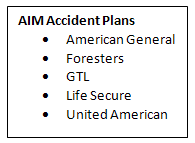

The sale of supplemental health insurance of all types is on the rise, including Personal Accident plans. That’s why we’ve beefed up our portfolio – we now have Accident plans from five different carriers, each with their own unique advantages.

The sale of supplemental health insurance of all types is on the rise, including Personal Accident plans. That’s why we’ve beefed up our portfolio – we now have Accident plans from five different carriers, each with their own unique advantages.

Take American General’s Accident Expense Plus plan for example.

Ideal for:

- Anyone who has a major medical plan with a significant deductable or large co-payments

- Anyone with limited access to health care providers

- Anyone seeking to reduce their out-of-pocket health care expenses

Producer Benefits

- Attractive compensation – not affected by health care reform

- Guaranteed issue – no underwriting, no medical exam required

- Simplified process – online applications with eSignature and voice signature available*

- Multiple payment options – including recurring credit card and EFT

- New opportunities – great cross sell for life insurance customers

Case Studies:

• Maria, 33, Graphic Designer

A broken leg won’t stop this leap into self-employment (Click for more)

Maria purchased a major medical plan with a low premium – but a $5,000 deductible. To help cover her high deductible and coinsurance costs, she supplemented the policy with an Accident Expense Plus® plan. She opted for the $7,000 per calendar year accident benefit with a $250 deductible.

Three months later, Maria fell, breaking her leg in two places. Her injury required an emergency room visit, surgery to reset the bone, three months in a cast and six weeks of physical therapy.

The medical bills could have derailed her business plans, but because Maria had an Accident Expense Plus® policy, her only expense was the $250 deductible. Broken leg or not, Maria kept marching steadily toward her goals.

*Not an actual case; presented for illustrative purposes only

• Jack, 16, Rising Basketball Star

Out-of-network specialist is an affordable part of the team (Click for more)

When he fractured his wrist in the playoffs, the family’s doctor referred him to a specialist outside their major medical carrier’s network. Thanks to the family’s Accident Expense Plus® policy, John and Samantha were promptly reimbursed for their out-of-network expenses and received additional benefits for the treatment and physical therapy.

Jack made a full recovery and was back on the court the following season. His bank shot–and his parents’ bank accounts–were as strong as ever.

*Not an actual case; presented for illustrative purposes only

• Janet, recreational downhill skier

Problem: Knee injury resulted in $12,650 of medical bills and three weeks lost compensation. (Click for more)

On the ride home with an ice pack on her knee, Janet began thinking about her next steps. She would go to the doctor first thing in the morning since it was late and she was not in unbearable pain. She had purchased new medical coverage a few months ago – an individual major medical plan and an Accident Expense Plus insurance policy with no deductible and a $5,000 calendar year maximum benefit. With relief, she remembered her agent explaining that the accident policy would help to cover the $2,500 deductible of her major medical plan, and she would most likely not incur any out-of-pocket medical costs due to the accident.

Janet made an appointment with her doctor for the next morning. When she referred to her Accident Expense Plus policy, she confirmed that the policy required her to see a doctor within 72 hours of her injury. During the appointment, Janet’s doctor ordered an X-ray which confirmed that nothing was broken. He then referred her to an orthopedic specialist — Dr. Thomas — to evaluate ligament damage. Dr. Thomas ordered an MRI which indicated that she had medial collateral ligament damage to her knee. The doctor advised her that surgery would be necessary but that the internal swelling would have to be reduced and the stabilization muscles would need to be strengthened before surgery. He prescribed ten physical therapy sessions. Janet completed her physical therapy sessions and returned to Dr. Thomas who ordered another MRI and confirmed Janet was ready for surgery.

After surgery, Janet continued with another 12 sessions of physical therapy. Her follow-up visit with Dr. Thomas revealed that she was healing nicely. Since the accident, Janet had accumulated three weeks of unpaid time-off from work.

Janet used $2,500 of her $5,000 Accident Expense Plus reimbursement to pay her major medical plan deductible. Since the remaining expenses were also covered 100 percent by her major medical plan, she had $2,500 left over to help pay living and other expenses while she was not able to work. Even though she had to endure the pain of an injury, she recovered with no out-of-pocket medical expenses or injury to her finances.

*Not an actual case; for illustrative purposes only